These companies work with us

Unlock Crypto Savings

Subscribe to our Telegram bot and get an exclusive discount on crypto courses!

Our courses are perfect for

Choose a course that fits your needs most

Crypto courses

Starter

Memecoins

Trading

AI Courses

Discover amazing study opportunities!

Flexibility

- Structured courses - Theory & Practice

- Opportunity to learn at your pace - Anytime, Anywhere

- Select your preferred language

- No experience required, beginner-friendly

- Access to the Discord channel

Support

- 24/7 doubt-clearing sessions with AI agents

- Mentor support

- Regular webinars and AMA sessions with experts

Community

- Friendly international community

- Leaderboard and games on the platform

- Unique NFTs for the best students

Advanced Features

- Advanced trading strategies and analytics

- Bonuses and discounts for new courses

- Certificate upon course completion

- Fantastic referral program

Climb the leaderboard and get our exclusive bonuses!

Earn with our referral program

Invite friends to study on our platform and receive cashback!

Unlock discounts with coins!

Use your platform coins to save on courses.

Get inspired

Learn how other students changed their careers and lives with the help of Duoschool

Check out the Latest from Our Blog

A meme coin is a type of cryptocurrency that originates from internet memes or popular cultural references. Simply said, they are coins based on memes (not a big surprise). Unlike mainstream cryptocurrencies like Bitcoin or Ethereum, which have clear utility and technological foundations, meme coins often start as jokes or trends. They typically gain value rapidly based on community hype and social media influence rather than inherent technological innovation. This makes them highly volatile and speculative compared to “classic” cryptocurrencies.

Some will say that their instability is bad. And some love them for it. After all, volatility entails not only great risks but also great opportunities! If you are ready to take this path, we will tell you about trading meme coins in this article.

What Is Meme Coin Trading and How Does It Work?

When you buy meme coins, you are fully aware that you are engaging in high-risk speculation. These are risky assets even by crypto standards. After all, unlike other types of digital assets, meme coins literally have no use. Only in rare cases can they be used to pay for donations or something similar.

-

Bitcoin

is not a meme coin because it’s used for payments and because of the technology behind it.

-

PEPE

is a meme coin because its use is limited, and the asset was created as a joke.

-

Toncoin

is not a meme coin because it has advanced blockchain technology and is used in the Telegram ecosystem.

-

DOGS

is a meme coin because it has no application (at least for now) and was launched to promote a trend, not a technology.

Well, you see, it’s clear enough.

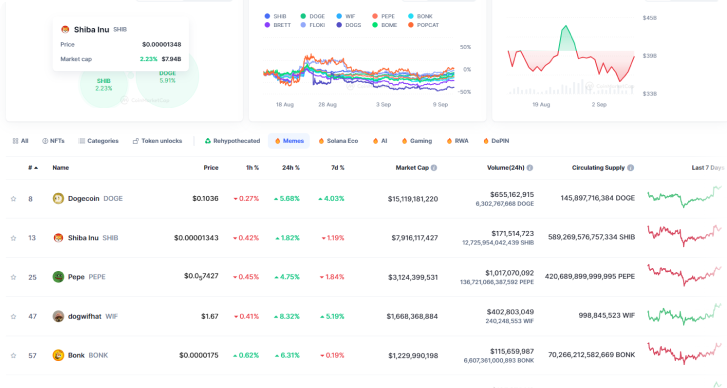

You can see the full list of popular meme coins on CoinMarketcap or CoinGecko.

Meme coins market (September 2024)

Meme coins are usually bought for the short or medium term. At the same time, it is important for you to be able to feel the market, anticipate fluctuations, and follow the news background. If you are good at this, you can make a lot of X's.

Pros and Cons of Investing in Meme Coins

We'll get to the meme coin trading strategy soon. But for now, let's go over the pros and cons so you know exactly where you're going.

Pros

-

Potential for high returns

Investors who got in early on meme coins like Dogecoin and Shiba Inu saw massive returns as these coins surged in value.

-

Strong community support

The value of meme coins often spikes due to active, enthusiastic communities on platforms like Twitter and Reddit.

-

Fun

Well, trading meme coins is just fun, and you can’t argue with that.

Cons

-

Extreme volatility

Meme coins are highly unpredictable, with prices that can skyrocket or plummet overnight.

-

Lack of fundamental value

Unlike other cryptocurrencies with specific technological functions, meme coins usually lack a solid foundation in utility, making them risky investments.

-

Pump and dump risks

The meme coin market is notorious for pump and dump schemes, where prices are artificially inflated just to be sold off by early holders for a profit, leaving later investors at a loss.

Now, when you understand the pros and cons of meme coins, think twice if you should invest in meme coins or not. On the one hand, most of the coins on the market are just scams. On the other hand, if you find a gem, it can make you rich overnight. And even buying a bad coin at a good time, you can ride the wave and get a good profit. Let’s figure out how to do this.

Meme Coin Trading Strategy: How to Snipe Meme Coins for Maximum Profit

Step 1: Research Upcoming Meme Coins

Keep an eye on cryptocurrency news websites, join online forums and social media groups focused on crypto. Platforms like Reddit, X, and Telegram are good places to start.

-

Tip

Use services like DexScreener to identify newly launched meme coins. Focus on those that are very recent and have potential for growth based on their market cap and other indicators.

Check how active and excited the community is around a new meme coin, who is talking about it, and what’s the theme. A big, energetic community and mentions by popular people can mean a coin might shoot up in value.

-

Red Flags

Watch out for projects that don’t share much about who’s behind them or make big promises about making money without any risk. These could be signs of a scam. You have to be very careful and selective, because the vast majority of all projects you can stumble upon are scams. However, even scam coins can bring you profit if you manage to get out in time.

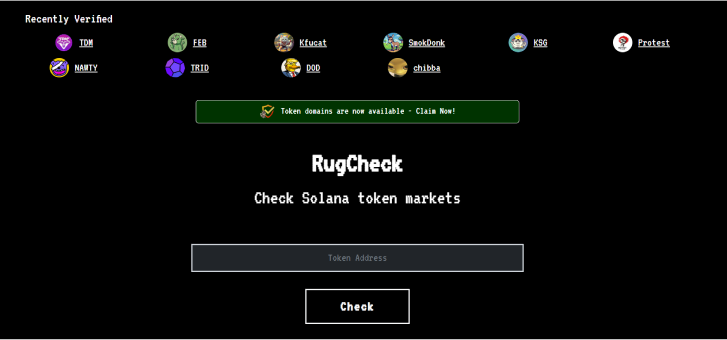

You may use tools like rugcheck.xyz to analyze the coin’s risk of being a scam.

Meme coins market (September 2024)

Step 2: Prepare Your Wallet

We hope you already know the basics of decentralized crypto trading. Let’s double-check:

-

You have a crypto wallet

-

You know how to send crypto transactions and sign smart contracts

-

You understand the difference between different blockchain networks

-

You have some amount of crypto on your wallet to pay transaction fees

If you are not sure about that, please learn the basics of crypto before you move on.

What blockchain is used for meme coins?

Most meme coins are ERC-20 tokens, including SHIBA, PEPE, and many others. DOGE is an exception. It has its own blockchain. Also, there are some popular meme coins in the Tron and Solana networks.

Make sure your digital wallet supports the type of blockchain the meme coin uses. For example, if the coin is on the Ethereum network, a wallet like MetaMask would work. If they are on the Tron network, Tron Wallet would be a perfect choice.

Step 3: Be Quick with Your Purchase

The best time to buy a meme coin is usually when it’s just starting to get noticed on social media but before everyone’s talking about it. This is often when the price starts to jump.

Use trusted exchanges (such as GraphDEX) and have your accounts set up ahead of time so you can buy quickly. meme coin prices can skyrocket in no time.

Trading Bots

If you have some technical skills, you may use trading bots. Some experienced traders use automated programs called trading bots to buy new tokens the moment they are launched. These bots are set up with rules to automatically execute a buy order when a new token hits the exchange. The bots work through the exchange’s API, which allows them to perform trades automatically based on pre-defined triggers, like the appearance of a new token listing. This setup helps traders purchase new tokens instantly, capitalizing on potential early price increases before other manual buyers can react.

Trading bots are an interesting topic, but too complex to cover in this article. Let's talk about them another time, but for now let's get back to meme coins.

Step 4: Know When to Sell

Decide how much you want to make from your investment before you buy, and sell once you hit that target. Buy when the market cap is low and sell when it is high.

Keep up with the latest news from the meme coin community and the crypto market. If you see signs that people are losing interest or if there’s bad news, it might be time to sell.

Think about selling in parts — first take back your initial investment if the price goes up, and then see if you can make more with what’s left. This way, you protect your initial money and might still profit more.

Note: For some projects, the ideal time from purchase to sale may be 5-30 minutes! If you don't trust the project, then pulling out money with a small profit in the first hours of trading can be a good decision.

Extra Tip

Always keep learning about the latest in the market and any important news that affects crypto. Knowing more can help you make smarter choices about when to buy and sell.

This approach focuses on being ready, making quick decisions, and always staying informed, which is crucial for dealing with the unpredictable nature of meme coin trading.

What to Look for When Trading Meme Coins

When trading meme coins, it’s crucial to have a solid strategy that incorporates thorough research. Here are specific factors to consider when evaluating meme coins as part of your meme coin trading strategy:

1. Community Strength

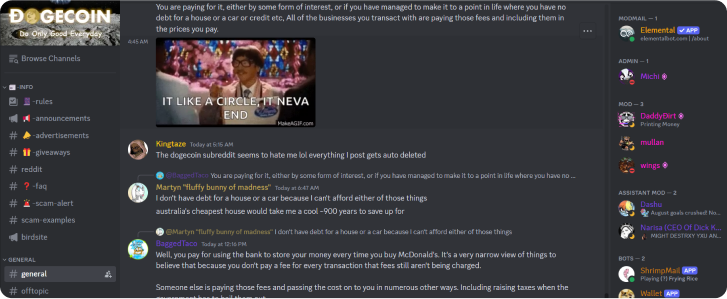

A strong, active community can drive up the price of a meme coin through social media and other platforms. Check for engagement on Twitter, Reddit, Discord, and Telegram.

Dogecoin community on Discord

Look for regular updates, frequent interactions between members, and growth in user numbers. A healthy community often correlates with price stability and potential spikes.

Please remember that there are lots of crypto projects with fake communities. To expose bots, pay attention to factors such as:

-

The ratio of likes to subscribers

If there are many subscribers and few likes, the subscribers are probably fake.

-

The meaningfulness of the messages in the chat

These are real questions and opinions, or simple messages in the spirit of "Good morning" and "Good project".

-

Subscribers’ profiles

If your followers' profiles look too simple or suspicious, they are probably bots.

2. Liquidity and Volume

High trading volume and liquidity mean that you can buy and sell the coin easily without affecting its price too much.

Where to Check:

Analyze trade volume data on coin tracking websites like CoinMarketCap or CoinGecko. Avoid coins with low daily trading volumes as they can be hard to sell and prone to price manipulation.

New projects are often not listed on these two platforms. If so, you can try finding them on websites like PoopCoin (BSC) or DexTools (all major blockchains).

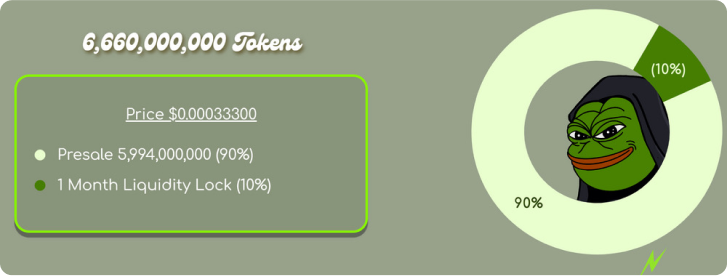

Tokenomics

-

Supply Details

Check how many coins are in circulation and if there’s a maximum supply cap. Coins with a huge supply or no cap can be less likely to appreciate in value.

-

Distribution Plan

Understand how coins are distributed. If too many coins are held by the founders or a small group, they can control the coin’s price, which could lead to sharp price drops if they decide to sell.

Evel Pepe coin tokenomics example: an oversimplified tokenimics

Important tip:

Don't trust the official tokenomics that projects distribute to the community. These tokenomics may be fake. Instead, track the proportion of real holders in the blockchain explorer by entering the token contract address.

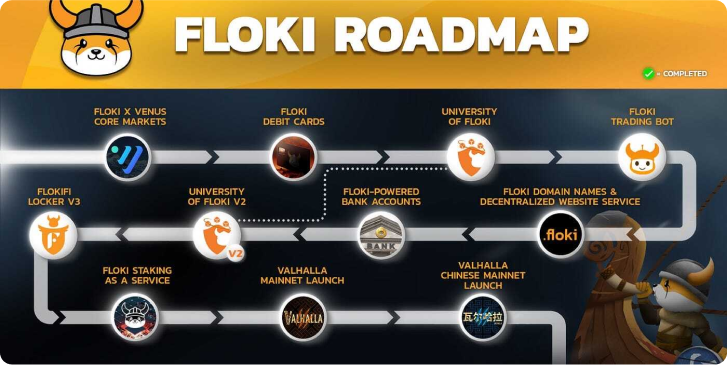

4. Development Team and Roadmap

Research the team behind the coin. A transparent, experienced team with a track record in other successful projects adds credibility.

Look at the roadmap for future developments. Projects with clear, realistic goals and regular updates on progress tend to inspire more investor confidence. By carefully analyzing these factors, you can better navigate the risks and opportunities in the meme coin market, enhancing your trading strategy.

FLOKI Roadmap as an example

Case Studies: Successful and Failed Meme Coins

Successful Meme Coins

Dogecoin (DOGE) Story

Originally created in 2013 as a joke, Dogecoin featured the face of the Shiba Inu dog from the "Doge" meme as its logo. Despite its humorous beginnings, it quickly amassed a massive following. Its appeal lay not just in its humor but also in its community's spirit, often using the coin for charitable donations and other community-driven efforts.

Success Factors:

-

Celebrity endorsement

The value of Dogecoin skyrocketed when personalities like Elon Musk tweeted about it, highlighting how significant influencers can impact these currencies.

-

Community engagement

Dogecoin’s community is known for its friendly and welcoming nature, often raising funds for various causes, which helped sustain its popularity.

Lesson: Community support combined with high-profile endorsements can significantly increase a coin's profile and value, even if it started as a joke.

Shiba Inu (SHIB) Story

Shiba Inu was created in August 2020, explicitly fashioned as the "Dogecoin killer." Its tokenomics involved issuing a massive total supply, with half sent to Ethereum co-founder Vitalik Buterin, who famously burned most of his holdings and donated a substantial amount to charity.

Success Factors:

-

Strategic supply management

The creator’s decision to send half the supply to Buterin created a narrative of scarcity and benevolence, driving up the price.

-

Viral marketing

Like Dogecoin, SHIB used a canine meme to attract a broad community, leveraging the already popular imagery associated with Dogecoin.

Lesson: Clever marketing and strategic moves regarding token supply can create scarcity and hype, leading to a surge in price.

Very detailed case study of SHIBA by Illinois University

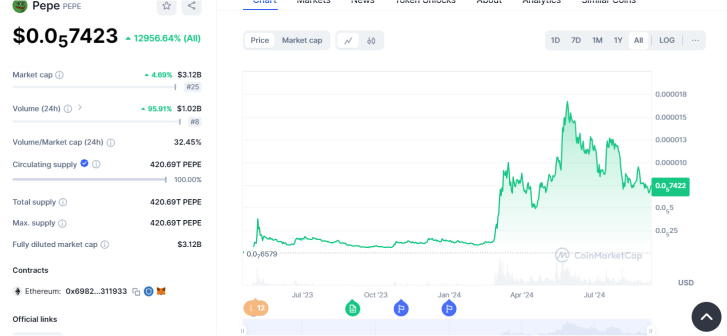

PepeCash (PEPE) Story

Pepecoin is a cryptocurrency that emerged from the playful spirit of internet culture, specifically inspired by the Pepe the Frog meme. It was designed as a community-centric project by one of the original creators involved with Dogecoin, reflecting a return to the whimsical roots of meme-driven digital currencies. Unlike many meme coins, Pepecoin is built on its own blockchain — a Layer 1 solution derived from a fork of Dogecoin.

The rise of PEPE

Pepecoin was launched with relatively little attention in April 2023. Despite its modest beginnings, the coin quickly gained traction thanks to a significant purchase that captured the community’s interest. An investor exchanged 0.125 ETH for a whopping 5.9 trillion Pepecoin tokens, highlighting the low initial price and vast token supply of 420 million — a playful nod to cannabis culture.

-

Perpetual Contracts Explained

The introduction of the 10000PEPEUSDT perpetual contract by RubyDex was a strategic move to facilitate easier trading. Each contract represents 10,000 Pepecoin tokens, making it simpler for traders to engage with Pepecoin's market dynamics without dealing with the high volume of individual tokens. This innovation allows traders to leverage Pepecoin's volatility to their advantage, managing risk more effectively while participating in the potential gains.

-

Lessons and Insights

The story of Pepecoin serves as a valuable case study in the volatile world of meme coins. It demonstrates that while these coins can offer substantial rewards, they also come with significant risks, particularly concerning price volatility and liquidity. The use of tools like perpetual contracts can provide traders with more flexibility and control, mitigating some of the inherent risks in meme coin trading.

These stories reveal that meme coins might begin as fun or jokes, but clever community involvement, smart positioning in the market, and finding unique purposes can turn them into real successes. However, it’s important to remember that not all meme coins achieve this success; many fail to gain traction or fizzle out after initial hype. Let’s look at some failed cases.

Failed Meme Coins

The Squid Game Token (SQUID) was a cryptocurrency inspired by the popularity of the Netflix show "Squid Game." It was marketed as a play-to-earn token, promising big rewards for winning online games similar to the show. However, it turned out to be a scam, leading to significant losses for many investors.

Here's the breakdown of what happened with SQUID:

The value of SQUID increased incredibly quickly, going from just a few cents to over $2,800 because everyone was excited about the show. Early on, there were signs that something wasn't right. The creators of SQUID were anonymous, there wasn't much clear information about the coin, and while people could buy it, they found they couldn't sell it.

SQUID price chart. In reality, it was even worse than it looks.

Eventually, the creators sold all their coins, pulled all the money from the project, and disappeared. This action crashed the value of the coin to nearly zero, and many people who invested lost their money.

Read news about SQUID from 2021

-

What we can learn from the SQUID case

Being popular doesn't always mean something is safe to invest in. It's important to thoroughly check out who is behind a cryptocurrency and how it actually works before putting in your money. If a coin is hard to sell, that's a major warning — it might be a setup for a scam. Always be extra careful if you can't find real information about the people behind the project.

However, there were those who managed to make money even on this scam coin. Those who sold the coins before the rag pool still managed to make a good profit.

By the way, the second season of the Squid Game is coming out soon. Should we expect a reboot of the coin?

Should You Invest in Meme Coins

So, let’s sum up.

Meme coins are highly volatile assets that typically lack a solid foundational purpose, making them inherently risky investments. This volatility can be both an advantage and a disadvantage. On one hand, the rapid price fluctuations can provide significant opportunities for high returns in a short amount of time. On the other hand, the lack of a concrete underlying value means these assets can just as quickly lose value.

The key to trading meme coins successfully lies in identifying those that have potential for growth-driven by factors like a strong community or viral popularity — and then timing the market to sell at their peak before their value declines. It's essential to stay informed and agile, capitalizing on trends quickly and exiting investments before hype fades. This strategy requires vigilance and a good sense of market timing to navigate the high-risk, high-reward nature of meme coin trading.

Are you ready to play this game?

Welcome to the DuoCrypto beginner's guide to crypto market trends! This guide is designed for those traders who are at the very beginning of their cryptocurrency journey and for those who just need to polish up their knowledge. Let’s review the basic concepts and trends defining the crypto market today!

Why Understanding Cryptocurrency Trends is Crucial for New Traders

Appreciating such trends in the cryptocurrency market is very important for novices trying to navigate this very dynamic world of Web3 to make better decisions that reduce risk while maximizing returns. Crypto trends may indicate the market sentiment, investor behavior, and emerging technologies in the market. For example, a wave of interest in DeFi applications may indicate a shift in preferences for making investments. Identifying these trends early could help traders position themselves to take advantage of opportunities as they arise.

Besides, understanding the trends of the crypto market would help you overcome uncertainty. The cryptocurrency market is quite volatile; therefore, by keeping up with the current trends, you can attempt to forecast some price volatility.

Learning crypto market trends will help traders to:

-

Reduce Risk

Decrease the number of costly mistakes.

-

Increase Return

Recognize when to buy low and sell high via market cycles and trends.

-

Navigate Uncertainty

Make correct, sharp decisions in a volatile market by being aware of what is going on.

Essentially, knowing the trends of the cryptocurrency market is like having a map when you cross a very complex terrain.

Global Cryptocurrency Market to Reach $2.2 Trillion by 2026, Driven by Mainstream Adoption

The global cryptocurrency market is poised to grow at an impressive rate in the years ahead; according to ResearchGate, it might even increase to $2.2 trillion by 2026. This surge, driven by mainstream adoption, points toward very drastic changes in the perception and use of digital currencies.

There are many reasons for this mainstreaming, but of course, the most important is the transparency and safety that technology offers in blockchain, the network upon which digital assets are built. In the current trends in cryptocurrency, it seems more than probable that the crypto market is growing. Now, with more people and businesses getting into the act with respect to digital money, innovation and development in this space can only go further.

What are Crypto Market Trends?

Market trends in crypto are the financial world’s fashion trends that people cannot help but pay attention to. They can be very dramatic, very suspenseful, and all too frequently, they are simply puzzling. Such trends are the macroscale vector that determines the general trend of the market’s evolution — this can be called the rhythm of the crypto market.

Tracking crypto trends is crucial if you want to make informed decisions rather than reacting impulsively. It is like having a guide to the different financial options available to consumers. This knowledge enables you to understand the market directions. It’s about comprehending the noise and then creating a signal that will lead a particular individual through the financial fog.

The Current Trends in Cryptocurrency for 2024

Digital assets are truly changing at an unbelievable pace, and it looks like 2024 promises to bring several landmark trends of cryptocurrency. From growing institutional involvement to the increasing prominence of decentralized finance (DeFi), the landscape of digital assets diversifies and matures. Here's a deeper look at some of the important crypto market trends shaping the world of Web3 today.

The Rise of Institutional Investments

Institutional investment in cryptocurrencies broke new records in 2024. Big financial institutions and corporations are deploying funds in digital assets more than ever before in the relentless pursuit of huge returns and diversification. This is part of a bigger trend of acceptance for cryptocurrencies as a legitimate asset class.

The current Web3 landscape is seeing more hedge funds, investment banks, and even publicly traded companies. For this to have been done, such shifts should not only be in the actual investments but also in strategic partnerships with blockchain startups and integrations of crypto services with traditional financial products. The entry of institutional capital is bringing further stability and legitimacy to the market, although it, at the same time, again raises a potential new risk of market manipulation and regulatory scrutiny.

Again, in 2016, the cryptocurrency trend picked up with institutional money pouring in following the release of the BitLicense by the New York State Department of Financial Services (NY DFS). This was followed by the subsequent decline and mostly attributed to an investigation by the US Securities and Exchange Commission (SEC) into Initial Coin Offerings (ICOs) by 2018.

The Role of DeFi in Crypto Market Trends

Decentralized Finance continued to grow rapidly into 2024. DeFi provides a wider selection of financial services, such as lending, borrowing, trading, or yield farming, which do not require a bank as an intermediary.

This crypto trend is pushed by the fact that DeFi avails financial services for an underserved population and hence seems to carry much potential for offering high returns on investments. Some other features that are being noticed include innovation in new financial instruments and products. In view of this, the DeFi ecosystem will further expand to include greater adoption and integration into mainstream economic systems.

Regulatory Changes Across the Globe

As the cryptocurrency industry matures, regulatory frameworks are becoming more defined. We observe a growing emphasis on the regulation of governments and financial authorities throughout the world. Such regulations are aimed at vital issues such as fraud, market manipulation, and customer protection, with a parallel advancement of innovations.

There are different approaches: some countries are becoming very severe in controlling activities with digital assets, while others are creating favorable environments to attract blockchain startups. These current trends in cryptocurrency could impact the growth and adoption of digital assets, from market stability to international trade.

China’s legalization and adoption of crypto-assets and Bitcoin mining in 2013 are prime examples of factors that drove the bullish crypto market that year. These government actions led to increased investment and adoption within the country. However, its momentum was quickly upset because the Mt. Gox digital currency exchange had to fold its operations due to a big hack.

Bitcoin Halving Cycles

Bitcoin halving events occur about every four years and remain a critical factor in the crypto trends. Historically, this kind of event has caused an increase in the BTC price because of the reduction in new coins supply, hence impacting market dynamics.

The next halving is expected to have such an impact on Bitcoin's price or even push it higher and on market behavior, attracting institutional investors and traders. While the historical relationship of halving events with price gains is significant, one should not overlook market sentiment, macroeconomic conditions, and regulatory outcomes, which also affect cryptocurrency trends.

NFTs vs. Crypto Trends

Though NFTs were at one point the next big trend of cryptocurrency, their relevance in 2024 has come under debate. Even though much of the initial hype around non-fungible tokens has died down, especially in art and collectibles, the technology that allowed them to take off in the first place is finding new use cases for the idea.

NFTs are used for other cases besides digital art, real estate, gaming, and intellectual property rights. Leading brands and entertainment industries are toying with non-fungible tokens in audience engagement and seeking to unlock new revenue streams. However, the process is not smooth, as NFT markets face challenges such as oversaturation and regulatory scrutiny.

Key Indicators that Influence Crypto Market Trends

Market Sentiment

Market sentiment is the spirit of the crypto market. It shows the mood of the traders and investors — whether they are happy, indifferent, or concerned. Positive sentiment takes the price to new highs, whereas negative sentiment drags it down.

Market moods assist you in dealing with these feelings of the market. On the other hand, indicators such as the Crypto Fear & Greed Index make one understand the overall vibes of the market so that they don't get themselves lost in the feelings of either fear or greed.

Supply and Demand

Supply and demand are the main drivers of the crypto trends. The price for digital assets is determined by the equilibrium level between the number of buyers (demand) and sellers (supply). If buyers exceed sellers, then the price will increase; if the reverse occurs, the price will decrease.

This can be based on market news, technological advancement, a change in rules and regulations, and the attitude and optimism/pessimism in the market. For instance, one positive piece of news regarding a certain cryptocurrency may increase demand and have a positive influence on its price, while the inverse is true.

Media and News Influence on Crypto Trends

There is no denying the influence of media on the trend of cryptocurrencies. News coverage, whether positive or negative, greatly impacts the sentiment within the market and in turn directly affects price swings. For example, strong support from a key figure or positive regulation news would raise prices, but a security incident or government crackdown would trigger the sale.

Or, alternatively, social media platforms like X (formerly Twitter) and Reddit have become powerful means for disseminating news and opinion within the crypto community. In such a case, prices change very quickly due to viral crypto market trends or the community's mood. That is why an investor needs to critically analyze the source of information and realize the potential impact of media coverage on Web3 markets.

Technological Developments

Or, alternatively, social media platforms like X (formerly Twitter) and Reddit have become powerful means for disseminating news and opinion within the crypto community. In such a case, prices change very quickly due to viral crypto market trends or the community's mood. That is why an investor needs to critically analyze the source of information and realize the potential impact of media coverage on Web3 markets.

Conclusion

A trip through the trends of the cryptocurrency market is no less exciting than a car chase in the best action thriller. But in this ever-evolving world, information is not only strength — it is your major asset when it comes to making the right decision and grabbing the chance. Follow the trends, know what is going on, and be cautious and enthusiastic at the same time when approaching the market. The ride through the crypto universe may be bumpy, but with the right tactics and information, you are fully prepared to maximize on every chance that you are given.

The popularity of cryptocurrencies grows every day. No wonder, since they are safe, fast, decentralized, and anonymous. Plus, transactions with digital assets are often cheaper than your regular bank transfers even if you need to send crypto from one part of the world to another. Moreover, crypto investments offer high potential returns. According to Statista, the number of crypto users has surpassed 420 million worldwide. And some other sources claim that there can be more than 560 million users.

However, before diving into the cryptocurrency universe, you need to understand the fundamentals of trading. In this article, we will discuss crypto trading strategies that will help you to navigate the volatile crypto market successfully.

Gone are the days when cryptocurrency was only of interest to a few enthusiasts. Today it is already a full-fledged financial instrument. It is traded on stock markets, hundreds of millions of people around the world invest in it, and it is accepted as payment by large corporations and small businesses. The "Cryptocurrency for Beginners" guide will help you better understand the working mechanisms of cryptocurrencies and how they can be used in your interests.

Why it’s Important to Learn About Trading Before Investing

You won’t be able to make a profit by simply buying and selling assets without thinking. That’s why you need to understand all the intricacies first. You need to be prepared for high volatility and rapid market shifts to avoid risks. Learning the basics of trading will help you to make informed decisions.

Fundamental Analysis in Crypto

Fundamental analysis in cryptocurrency is the process of evaluating a cryptocurrency’s underlying value to determine its long-term potential. Its key metrics include:

-

Market Capitalization helps to understand a crypto’s market dominance.

-

Liquidity shows how easily an asset can be bought or sold without affecting the price.

-

Token Utility determines the practical use cases of an asset.

-

Network Activity focuses on the level of activity on a blockchain and a crypto’s potential for growth.

Technical Analysis in Crypto

Technical analysis allows traders to predict upcoming price movements of a cryptocurrency by evaluating historical price data and market statistics. Its key metrics include:

-

Candlestick Charts visualize a crypto’s price movements (for example, highs and lows).

-

Moving Averages help to average the prices from certain periods in order to identify trends.

-

Moving Averages help to average the prices from certain periods in order to identify trends.

-

MACD (Moving Average Convergence Divergence) shows a relationship between two Moving Averages.

Top 15 Crypto Trading Strategies for Beginners

Now, let’s take a look at the most important crypto strategies.

Strategy #1: Buy and HODL

Now, when you understand the pros and cons of meme coins, think twice if you should invest in meme coins or not. On the one hand, most of the coins on the market are just scams. On the other hand, if you find a gem, it can make you rich overnight. And even buying a bad coin at a good time, you can ride the wave and get a good profit. Let’s figure out how to do this.

Strategy #2: Dollar-Cost Averaging (DCA)

This crypto trading strategy requires investing a certain amount of money regularly regardless of market conditions. It helps to avoid volatility by averaging the purchase over time.

Strategy #3: Scalping

The third strategy focuses on smaller profits from minor price changes. It requires traders to make multiple trades per day with the goal to “scalp” profits.

Strategy #4: Swing Trading

Traders who use this strategy hold their positions for a few days or weeks to profit from expected market swings. They carefully analyze trends and find the right entry and exit points.

Strategy #5: Arbitrage Trading

This strategy allows traders to exploit price differences on exchanges. To make a profit, they buy a digital asset on one exchange for less and sell it on a different exchange for more. However, arbitrage trading requires quick reactions.

Strategy #6: News-Based Trading

The fans of this cryptocurrency trading strategy make their decisions based on the news that may affect cryptocurrency prices. Traders always monitor important updates to sell or buy a digital asset before it becomes less profitable.

Strategy #7: Trend Trading

When using this strategy, traders rely on identifying the prevailing trend in the market. They open positions in its direction and hold them until the situation changes.

Strategy #8: Range Trading

This strategy is all about finding the support and resistance levels and using this range to trade. Traders usually buy at the support level and sell at the resistance level.

Strategy #9: Breakout Trading

Those traders who prefer this strategy usually enter the position when the price breaks through a significant level of resistance or support. They look for a profit in increased volatility that follows a breakout.

Strategy #10: Margin Trading

This option allows traders to use borrowed funds. If they succeed, their profit will be much higher. However, the risks are increased as well.

Strategy #11: Staking and Earning Interest

Many crypto exchanges offer staking tools. Traders who prefer this strategy deposit their funds to such exchanges and platforms to make a passive income from their holdings.

Strategy #12: Copy Trading

This strategy is often used by beginners. They replicate the trades of more experienced traders on the platforms that offer copy trading tools. It’s considered to be a great way to learn crypto trading from those who already know how crypto trading works.

Strategy #13: Grid Trading

Those who opt for this strategy regularly place buy and sell orders below and above a set price. It’s supposed to help profit from market volatility.

Strategy #14: Yield Farming

This strategy involves providing liquidity to DeFi protocols. In return, you can earn rewards. It can be very profitable, yet you need to understand the DeFi market and its risks.

Strategy #15: Liquidity Mining

In the case of Liquidity Mining, traders provide liquidity to exchanges and other platforms in order to earn assets. This strategy is quite popular but also quite risky.

How to Learn Cryptocurrency Trading

DUOCRYPTO is an educational platform that offers interactive cryptocurrency and AI courses. Their programs are created by experts and are aimed at turning you from a beginner to a pro. You can start from crypto fundamentals and work your way up while earning bonuses for hitting milestones and inviting friends. Check out their courses to learn crypto trading strategies!

Start Your Crypto Trading Journey Right

Crypto trading can be very lucrative when approached correctly. In this article we described fifteen main trading strategies that can help you with your crypto journey. However, you need to learn about each of them in detail before investing. How to learn crypto trading techniques? You can do it on your own or use the help of professionals from educational platforms like DUOCRYPTO.

In this article, we have gathered all the information for crypto-newbies, from basic concepts to practical investment tips.

Read more