How to Trade Meme Coins: Learn to Make Money Even on Ecams

A meme coin is a type of cryptocurrency that originates from internet memes or popular cultural references. Simply said, they are coins based on memes (not a big surprise). Unlike mainstream cryptocurrencies like Bitcoin or Ethereum, which have clear utility and technological foundations, meme coins often start as jokes or trends. They typically gain value rapidly based on community hype and social media influence rather than inherent technological innovation. This makes them highly volatile and speculative compared to “classic” cryptocurrencies.

Some will say that their instability is bad. And some love them for it. After all, volatility entails not only great risks but also great opportunities! If you are ready to take this path, we will tell you about trading meme coins in this article.

What Is Meme Coin Trading and How Does It Work?

When you buy meme coins, you are fully aware that you are engaging in high-risk speculation. These are risky assets even by crypto standards. After all, unlike other types of digital assets, meme coins literally have no use. Only in rare cases can they be used to pay for donations or something similar.

-

Bitcoin

is not a meme coin because it’s used for payments and because of the technology behind it.

-

PEPE

is a meme coin because its use is limited, and the asset was created as a joke.

-

Toncoin

is not a meme coin because it has advanced blockchain technology and is used in the Telegram ecosystem.

-

DOGS

is a meme coin because it has no application (at least for now) and was launched to promote a trend, not a technology.

Well, you see, it’s clear enough.

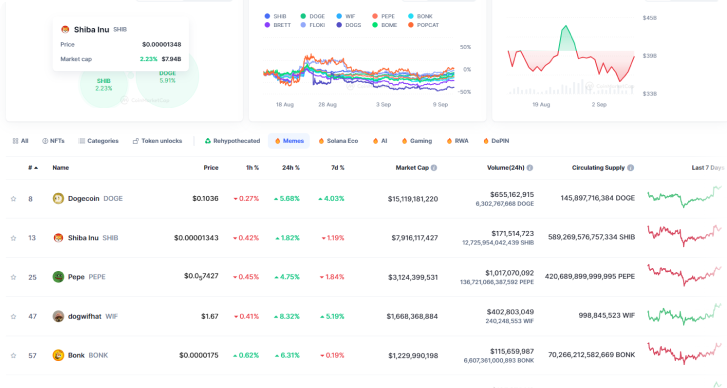

You can see the full list of popular meme coins on CoinMarketcap or CoinGecko.

Meme coins market (September 2024)

Meme coins are usually bought for the short or medium term. At the same time, it is important for you to be able to feel the market, anticipate fluctuations, and follow the news background. If you are good at this, you can make a lot of X's.

Pros and Cons of Investing in Meme Coins

We'll get to the meme coin trading strategy soon. But for now, let's go over the pros and cons so you know exactly where you're going.

Pros

-

Potential for high returns

Investors who got in early on meme coins like Dogecoin and Shiba Inu saw massive returns as these coins surged in value.

-

Strong community support

The value of meme coins often spikes due to active, enthusiastic communities on platforms like Twitter and Reddit.

-

Fun

Well, trading meme coins is just fun, and you can’t argue with that.

Cons

-

Extreme volatility

Meme coins are highly unpredictable, with prices that can skyrocket or plummet overnight.

-

Lack of fundamental value

Unlike other cryptocurrencies with specific technological functions, meme coins usually lack a solid foundation in utility, making them risky investments.

-

Pump and dump risks

The meme coin market is notorious for pump and dump schemes, where prices are artificially inflated just to be sold off by early holders for a profit, leaving later investors at a loss.

Now, when you understand the pros and cons of meme coins, think twice if you should invest in meme coins or not. On the one hand, most of the coins on the market are just scams. On the other hand, if you find a gem, it can make you rich overnight. And even buying a bad coin at a good time, you can ride the wave and get a good profit. Let’s figure out how to do this.

Meme Coin Trading Strategy: How to Snipe Meme Coins for Maximum Profit

Step 1: Research Upcoming Meme Coins

Keep an eye on cryptocurrency news websites, join online forums and social media groups focused on crypto. Platforms like Reddit, X, and Telegram are good places to start.

-

Tip

Use services like DexScreener to identify newly launched meme coins. Focus on those that are very recent and have potential for growth based on their market cap and other indicators.

Check how active and excited the community is around a new meme coin, who is talking about it, and what’s the theme. A big, energetic community and mentions by popular people can mean a coin might shoot up in value.

-

Red Flags

Watch out for projects that don’t share much about who’s behind them or make big promises about making money without any risk. These could be signs of a scam. You have to be very careful and selective, because the vast majority of all projects you can stumble upon are scams. However, even scam coins can bring you profit if you manage to get out in time.

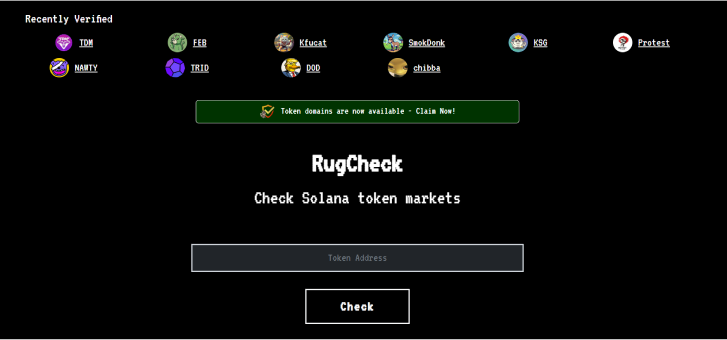

You may use tools like rugcheck.xyz to analyze the coin’s risk of being a scam.

Meme coins market (September 2024)

Step 2: Prepare Your Wallet

We hope you already know the basics of decentralized crypto trading. Let’s double-check:

-

You have a crypto wallet

-

You know how to send crypto transactions and sign smart contracts

-

You understand the difference between different blockchain networks

-

You have some amount of crypto on your wallet to pay transaction fees

If you are not sure about that, please learn the basics of crypto before you move on.

What blockchain is used for meme coins?

Most meme coins are ERC-20 tokens, including SHIBA, PEPE, and many others. DOGE is an exception. It has its own blockchain. Also, there are some popular meme coins in the Tron and Solana networks.

Make sure your digital wallet supports the type of blockchain the meme coin uses. For example, if the coin is on the Ethereum network, a wallet like MetaMask would work. If they are on the Tron network, Tron Wallet would be a perfect choice.

Step 3: Be Quick with Your Purchase

The best time to buy a meme coin is usually when it’s just starting to get noticed on social media but before everyone’s talking about it. This is often when the price starts to jump.

Use trusted exchanges (such as GraphDEX) and have your accounts set up ahead of time so you can buy quickly. meme coin prices can skyrocket in no time.

Trading Bots

If you have some technical skills, you may use trading bots. Some experienced traders use automated programs called trading bots to buy new tokens the moment they are launched. These bots are set up with rules to automatically execute a buy order when a new token hits the exchange. The bots work through the exchange’s API, which allows them to perform trades automatically based on pre-defined triggers, like the appearance of a new token listing. This setup helps traders purchase new tokens instantly, capitalizing on potential early price increases before other manual buyers can react.

Trading bots are an interesting topic, but too complex to cover in this article. Let's talk about them another time, but for now let's get back to meme coins.

Step 4: Know When to Sell

Decide how much you want to make from your investment before you buy, and sell once you hit that target. Buy when the market cap is low and sell when it is high.

Keep up with the latest news from the meme coin community and the crypto market. If you see signs that people are losing interest or if there’s bad news, it might be time to sell.

Think about selling in parts — first take back your initial investment if the price goes up, and then see if you can make more with what’s left. This way, you protect your initial money and might still profit more.

Note: For some projects, the ideal time from purchase to sale may be 5-30 minutes! If you don't trust the project, then pulling out money with a small profit in the first hours of trading can be a good decision.

Extra Tip

Always keep learning about the latest in the market and any important news that affects crypto. Knowing more can help you make smarter choices about when to buy and sell.

This approach focuses on being ready, making quick decisions, and always staying informed, which is crucial for dealing with the unpredictable nature of meme coin trading.

What to Look for When Trading Meme Coins

When trading meme coins, it’s crucial to have a solid strategy that incorporates thorough research. Here are specific factors to consider when evaluating meme coins as part of your meme coin trading strategy:

1. Community Strength

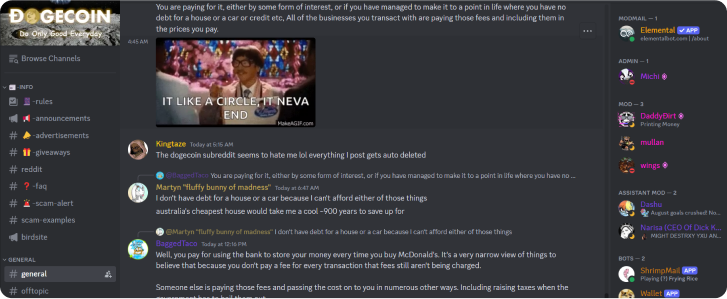

A strong, active community can drive up the price of a meme coin through social media and other platforms. Check for engagement on Twitter, Reddit, Discord, and Telegram.

Dogecoin community on Discord

Look for regular updates, frequent interactions between members, and growth in user numbers. A healthy community often correlates with price stability and potential spikes.

Please remember that there are lots of crypto projects with fake communities. To expose bots, pay attention to factors such as:

-

The ratio of likes to subscribers

If there are many subscribers and few likes, the subscribers are probably fake.

-

The meaningfulness of the messages in the chat

These are real questions and opinions, or simple messages in the spirit of "Good morning" and "Good project".

-

Subscribers’ profiles

If your followers' profiles look too simple or suspicious, they are probably bots.

2. Liquidity and Volume

High trading volume and liquidity mean that you can buy and sell the coin easily without affecting its price too much.

Where to Check:

Analyze trade volume data on coin tracking websites like CoinMarketCap or CoinGecko. Avoid coins with low daily trading volumes as they can be hard to sell and prone to price manipulation.

New projects are often not listed on these two platforms. If so, you can try finding them on websites like PoopCoin (BSC) or DexTools (all major blockchains).

Tokenomics

-

Supply Details

Check how many coins are in circulation and if there’s a maximum supply cap. Coins with a huge supply or no cap can be less likely to appreciate in value.

-

Distribution Plan

Understand how coins are distributed. If too many coins are held by the founders or a small group, they can control the coin’s price, which could lead to sharp price drops if they decide to sell.

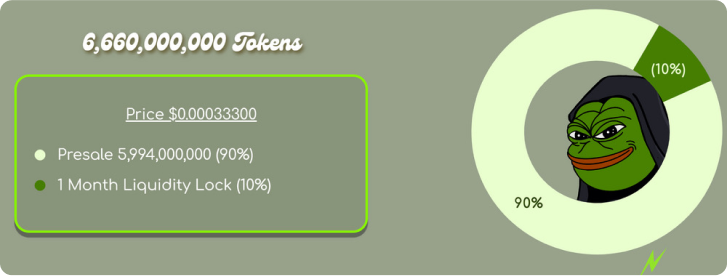

Evel Pepe coin tokenomics example: an oversimplified tokenimics

Important tip:

Don't trust the official tokenomics that projects distribute to the community. These tokenomics may be fake. Instead, track the proportion of real holders in the blockchain explorer by entering the token contract address.

4. Development Team and Roadmap

Research the team behind the coin. A transparent, experienced team with a track record in other successful projects adds credibility.

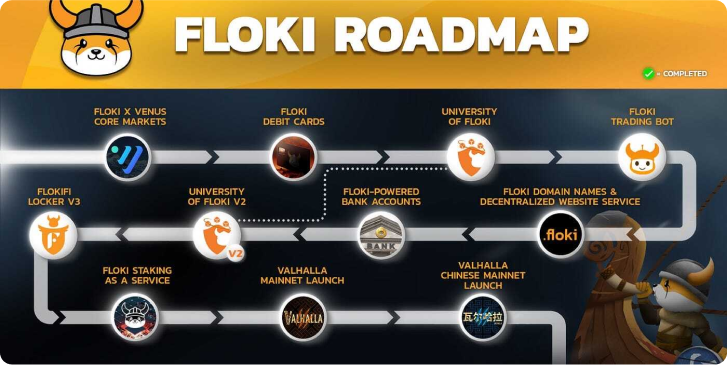

Look at the roadmap for future developments. Projects with clear, realistic goals and regular updates on progress tend to inspire more investor confidence. By carefully analyzing these factors, you can better navigate the risks and opportunities in the meme coin market, enhancing your trading strategy.

FLOKI Roadmap as an example

Case Studies: Successful and Failed Meme Coins

Successful Meme Coins

Dogecoin (DOGE) Story

Originally created in 2013 as a joke, Dogecoin featured the face of the Shiba Inu dog from the "Doge" meme as its logo. Despite its humorous beginnings, it quickly amassed a massive following. Its appeal lay not just in its humor but also in its community's spirit, often using the coin for charitable donations and other community-driven efforts.

Success Factors:

-

Celebrity endorsement

The value of Dogecoin skyrocketed when personalities like Elon Musk tweeted about it, highlighting how significant influencers can impact these currencies.

-

Community engagement

Dogecoin’s community is known for its friendly and welcoming nature, often raising funds for various causes, which helped sustain its popularity.

Lesson: Community support combined with high-profile endorsements can significantly increase a coin's profile and value, even if it started as a joke.

Shiba Inu (SHIB) Story

Shiba Inu was created in August 2020, explicitly fashioned as the "Dogecoin killer." Its tokenomics involved issuing a massive total supply, with half sent to Ethereum co-founder Vitalik Buterin, who famously burned most of his holdings and donated a substantial amount to charity.

Success Factors:

-

Strategic supply management

The creator’s decision to send half the supply to Buterin created a narrative of scarcity and benevolence, driving up the price.

-

Viral marketing

Like Dogecoin, SHIB used a canine meme to attract a broad community, leveraging the already popular imagery associated with Dogecoin.

Lesson: Clever marketing and strategic moves regarding token supply can create scarcity and hype, leading to a surge in price.

Very detailed case study of SHIBA by Illinois University

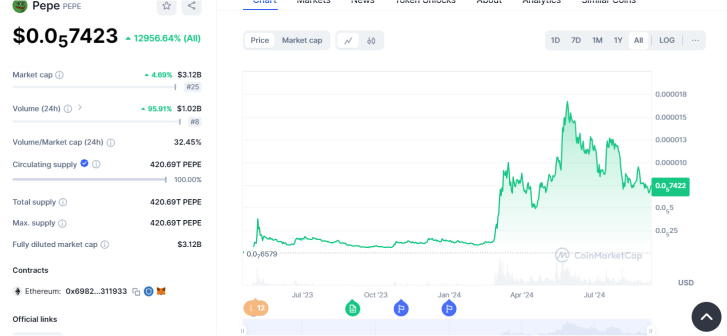

PepeCash (PEPE) Story

Pepecoin is a cryptocurrency that emerged from the playful spirit of internet culture, specifically inspired by the Pepe the Frog meme. It was designed as a community-centric project by one of the original creators involved with Dogecoin, reflecting a return to the whimsical roots of meme-driven digital currencies. Unlike many meme coins, Pepecoin is built on its own blockchain — a Layer 1 solution derived from a fork of Dogecoin.

The rise of PEPE

Pepecoin was launched with relatively little attention in April 2023. Despite its modest beginnings, the coin quickly gained traction thanks to a significant purchase that captured the community’s interest. An investor exchanged 0.125 ETH for a whopping 5.9 trillion Pepecoin tokens, highlighting the low initial price and vast token supply of 420 million — a playful nod to cannabis culture.

-

Perpetual Contracts Explained

The introduction of the 10000PEPEUSDT perpetual contract by RubyDex was a strategic move to facilitate easier trading. Each contract represents 10,000 Pepecoin tokens, making it simpler for traders to engage with Pepecoin's market dynamics without dealing with the high volume of individual tokens. This innovation allows traders to leverage Pepecoin's volatility to their advantage, managing risk more effectively while participating in the potential gains.

-

Lessons and Insights

The story of Pepecoin serves as a valuable case study in the volatile world of meme coins. It demonstrates that while these coins can offer substantial rewards, they also come with significant risks, particularly concerning price volatility and liquidity. The use of tools like perpetual contracts can provide traders with more flexibility and control, mitigating some of the inherent risks in meme coin trading.

These stories reveal that meme coins might begin as fun or jokes, but clever community involvement, smart positioning in the market, and finding unique purposes can turn them into real successes. However, it’s important to remember that not all meme coins achieve this success; many fail to gain traction or fizzle out after initial hype. Let’s look at some failed cases.

Failed Meme Coins

The Squid Game Token (SQUID) was a cryptocurrency inspired by the popularity of the Netflix show "Squid Game." It was marketed as a play-to-earn token, promising big rewards for winning online games similar to the show. However, it turned out to be a scam, leading to significant losses for many investors.

Here's the breakdown of what happened with SQUID:

The value of SQUID increased incredibly quickly, going from just a few cents to over $2,800 because everyone was excited about the show. Early on, there were signs that something wasn't right. The creators of SQUID were anonymous, there wasn't much clear information about the coin, and while people could buy it, they found they couldn't sell it.

SQUID price chart. In reality, it was even worse than it looks.

Eventually, the creators sold all their coins, pulled all the money from the project, and disappeared. This action crashed the value of the coin to nearly zero, and many people who invested lost their money.

Read news about SQUID from 2021

-

What we can learn from the SQUID case

Being popular doesn't always mean something is safe to invest in. It's important to thoroughly check out who is behind a cryptocurrency and how it actually works before putting in your money. If a coin is hard to sell, that's a major warning — it might be a setup for a scam. Always be extra careful if you can't find real information about the people behind the project.

However, there were those who managed to make money even on this scam coin. Those who sold the coins before the rag pool still managed to make a good profit.

By the way, the second season of the Squid Game is coming out soon. Should we expect a reboot of the coin?

Should You Invest in Meme Coins

So, let’s sum up.

Meme coins are highly volatile assets that typically lack a solid foundational purpose, making them inherently risky investments. This volatility can be both an advantage and a disadvantage. On one hand, the rapid price fluctuations can provide significant opportunities for high returns in a short amount of time. On the other hand, the lack of a concrete underlying value means these assets can just as quickly lose value.

The key to trading meme coins successfully lies in identifying those that have potential for growth-driven by factors like a strong community or viral popularity — and then timing the market to sell at their peak before their value declines. It's essential to stay informed and agile, capitalizing on trends quickly and exiting investments before hype fades. This strategy requires vigilance and a good sense of market timing to navigate the high-risk, high-reward nature of meme coin trading.

Are you ready to play this game?